Mastering Accounting Bookkeeping for Your Business Success

Accounting bookkeeping is the backbone of every successful business. Whether you're a small startup or a large corporation, understanding the principles of bookkeeping is essential for your financial health. This article will explore the intricacies of accounting bookkeeping, its importance, and how it can lead to better decision-making and overall success in your business.

What is Accounting Bookkeeping?

At its core, accounting bookkeeping involves the systematic recording and organizing of financial transactions. This practice ensures that all monetary activities are documented accurately, allowing businesses to track their income and expenses effectively. The discipline of bookkeeping encompasses various tasks, including:

- Recording daily transactions

- Managing accounts payable and receivable

- Preparing financial statements

- Reconciling bank statements

- Maintaining the general ledger

Mastering accounting bookkeeping can dramatically impact your business by providing precise insights into your financial performance.

Why is Accounting Bookkeeping Important for Businesses?

Effective accounting bookkeeping is critical for a multitude of reasons that extend far beyond mere number-crunching:

1. Financial Clarity

Accurate bookkeeping provides a clear view of your business’s financial status. When all transactions are properly recorded, stakeholders can easily understand where the company stands financially.

2. Enhanced Decision-Making

With detailed financial records, business owners can make informed decisions based on historical data. This insight allows for strategic planning, forecasting, and budgeting.

3. Compliance with Regulations

Many businesses are required to maintain accurate financial records by law. Proper bookkeeping ensures compliance with tax obligations and other financial regulations, minimizing the risk of legal issues.

4. Facilitated Tax Preparation

Tax season can be stressful, but organized financial records simplify the process. Having your books in order can save you time and money when preparing your tax returns.

5. Improved Cash Flow Management

Understanding income and expenses is vital for maintaining healthy cash flow. Accounting bookkeeping assists in tracking unpaid invoices and managing outgoing expenses effectively.

The Key Components of Accounting Bookkeeping

To understand accounting bookkeeping in-depth, you must familiarize yourself with its key components:

1. The General Ledger

The general ledger is a comprehensive record that contains all accounting transactions. It consists of accounts that classify expenses, revenues, assets, and liabilities.

2. Chart of Accounts

The chart of accounts is a listing of all accounts in the general ledger, organized into categories. It serves as a framework for financial reporting and analysis.

3. Journals

Journals are used to chronologically record transactions before they are transferred to the general ledger. This allows for an organized approach to bookkeeping.

4. Financial Statements

Key financial statements include the balance sheet, income statement, and cash flow statement. Together, they provide a snapshot of the business’s financial health and performance.

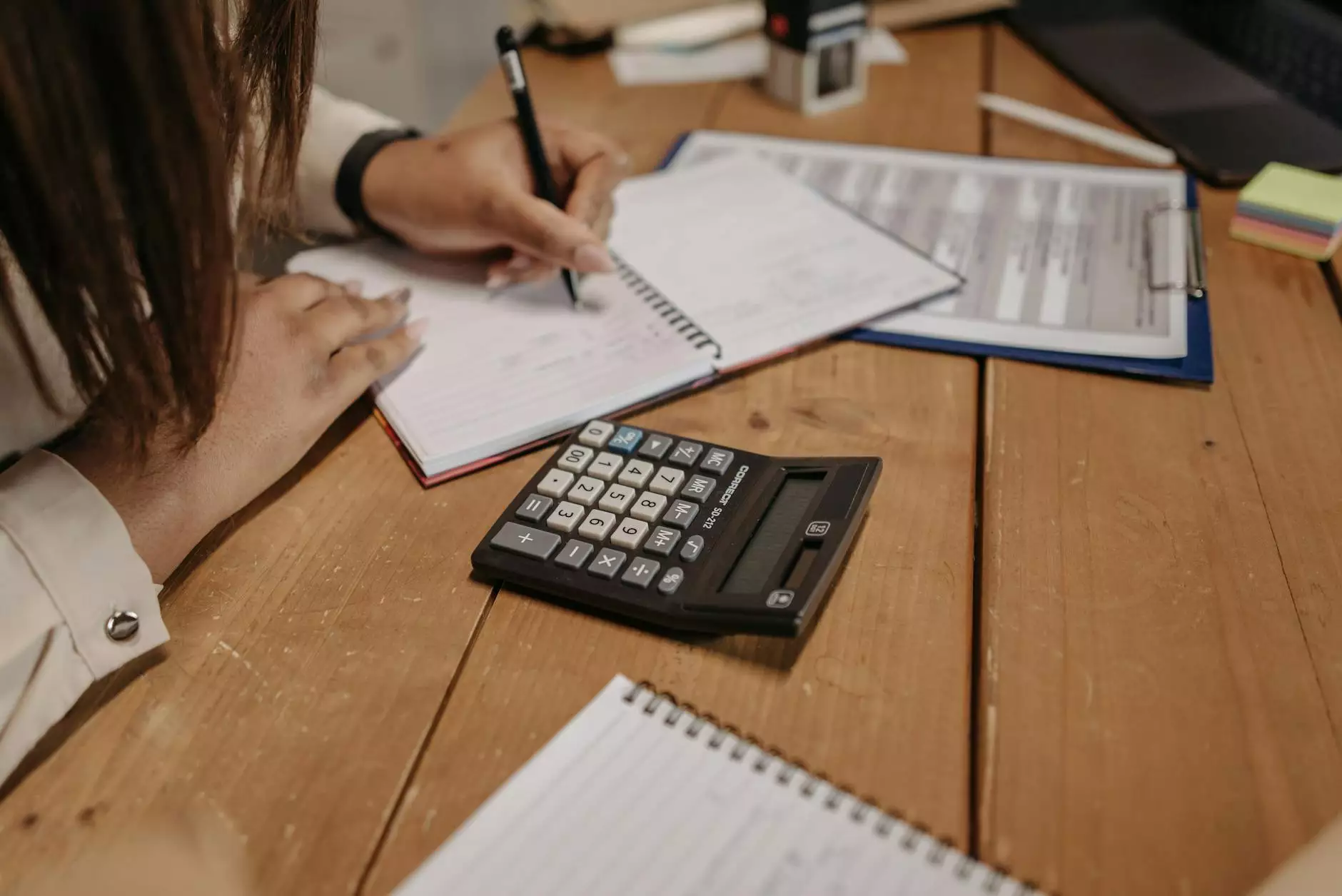

Best Practices for Effective Accounting Bookkeeping

Maintaining a streamlined bookkeeping process is essential for any business. Here are some best practices:

1. Regularly Update Your Records

Consistency is key. Updating your financial records regularly ensures that you have the most accurate information available. This includes recording transactions on a daily or weekly basis rather than letting them pile up.

2. Utilize Accounting Software

Investing in good accounting bookkeeping software can simplify your processes and improve accuracy. Programs like QuickBooks, Xero, and FreshBooks can automate many tasks, making life easier for business owners.

3. Reconcile Bank Accounts Monthly

Timely reconciliation of bank accounts helps spot discrepancies and maintain accurate records. This practice minimizes potential errors and fraud.

4. Keep Personal and Business Finances Separate

Mixing personal and business finances can lead to confusion and complicate bookkeeping. Always keep separate bank accounts and credit cards for personal and business expenses.

5. Seek Professional Help

If bookkeeping becomes overwhelming, consider hiring a professional accountant or bookkeeper. Their expertise can free up your time and ensure your books are in order.

Leveraging Accounting Bookkeeping for Strategic Financial Planning

Once a strong bookkeeping system is in place, businesses can leverage their financial data for strategic planning:

1. Budgeting and Forecasting

With access to accurate financial records, companies can create realistic budgets that account for historical spending patterns. This foresight assists in allocating resources effectively.

2. Identifying Trends

Analyzing financial data can unearth valuable trends in income and expenses, helping businesses make informed decisions about scaling operations or cutting costs.

3. Making Investment Decisions

Accurate financial records inform potential investors or partners about your business’s financial health, making it easier to secure funding.

Conclusion: Strengthening Your Business with Accounting Bookkeeping

In conclusion, mastering accounting bookkeeping is not just about keeping the books in order. It represents a fundamental aspect of running a successful business. By investing time and resources into effective bookkeeping practices, you can gain financial clarity, improve your decision-making capabilities, ensure compliance, and ultimately steer your business toward success.

For more information on how accounting bookkeeping can transform your business, visit us at BooksLA, where we specialize in financial services, financial advising, and accounting expertise tailored to your needs.

accounting book keeping